Also, download this story from the electronic issue here

As Asia advances towards urbanisation, a modern phenomenon that means increased migration, consumerism and industrialisation will boost demand for materialenhancing compounds such as masterbatches and additives. Meanwhile, there is growing interest in graphene-based masterbatches

Urbanisation in Asia is no more a legend, but real as the statistics for urban households escalates. It translates to a growing number of housing and infrastructure being built; more cars to plying the roads, and megacities emerging with increased population as urbanisation goes full scale in the region.

An estimated 44 million people are being added to Asia’s urban population every year; and by 2025, the majority of Asia’s population will be urban, according to an Asian Development Bank (ADB) report on Asian prospects to 2050. It is expected that by 2050, the number of urban dwellers will double from the current 1.6 billion to approximately 3.2 billion.

Singapore-headquartered DBS Bank also released a report early this year on Asian spending and it suggested that living standards are levelling up. What this means is that consumers are also becoming more educated and sophisticated in their demands and product choices.

Evidently, sectors that will derive the greater benefits from urbanisation include automotive, packaging, consumer goods, and construction, to name few.

Research firm Global Industry Analyst (GIA) finds that end-use markets served by the above sectors are driving demand for plastics. An essential component now to plastics, masterbatches are becoming a widely used colourant method to enhance properties fit for an urbanised consumer base. Thus, the global market for masterbatches is projected to reach US$10.5 billion by 2018, said GIA.

GIA, in its report, also points to packaging as the largest end-use market for masterbatches. It finds that more consumer product manufacturers are seeking packaging materials that facilitate low cost production, and ensure effective storage and transportation.These requirements provide the edge to advanced masterbatches that offer both functional performance and aesthetic appeal.

New York-based Persistence Research says that Asia Pacific was the largest market for masterbatches in 2013, as demand in plastics from the construction and automotive industries surged.

Infniti Research’s latest report cites that masterbatches allow moulders to improve the appearance and performance of the raw polymer or resin in a cost-effective manner during manufacture of plastics. Demand for pigment additives, it says, is projected in the report to grow to a CAGR of 5.3% through to 2018.

New choices, innovations

As new plastic materials are being developed and enhanced, masterbatch makers innovate to gain a competitive edge in the market. Several of these innovations include anti-shrinkage and anti-fogging additives for packaging; flame-retardants for PP pipes and PC sheets; anti-microbial and odour managing additives as well as for for biopolymer and biodegradable resins, says GIA.

Several producers have come up with new innovations. Switzerland-based Granula has identified the challenge of adding colour to a polymer being processed. Choosing which masterbatch and how much to use to yield the desired effect is a serious consideration for converters, it says.

Thus, Granula, together with a team of mechanical engineering students from Germanybased Reutlingen University, developed a test specimen to help customers oversee their masterbatch decisions at an early stage, before the product goes into series production. According to Granula, the test specimen enables customers to analyse a number of important properties of coloured plastics and plastic part design requirements in advance. Based on this test specimen, various constructional and design aspects can be tested in order to determine whether a colour performance is delivered that is compliant with the specification of the relevant plastic part.

The new test specimens will be demonstrated on a Boy 25E injection-moulding machine at the upcoming Fakuma show to be held in Germany in October.

Elsewhere, Israel-headquartered Tosaf, a joint venture between Megides Holding and the Ravago Group, has launched a new cooling masterbatch for greenhouse film applications.

Films produced using IR8783PE block a significant amount of the near infrared radiation (NIR), which would heat up the greenhouse’s interior. Field trials in South Israel revealed a peak temperature 4-5°C lower when compared with conventional light-diffusing film, with no undesired temperature drop overnight.

The IR8783PE allows most of the photo-synthetically active radiation (PAR), needed for healthy plant growth, to pass through the films. The masterbatch is suitable for single, three, and five-layer films, with a recommended rate of addition of about 5% for a 200-micron film, Tosaf said.

Meanwhile, Netherlands-based Helian Polymers, a new player in masterbatch manufacturing (the company was launched in 2011) has teamed up with Eastman Chemical Company in producing a low-odour, styrene-free polymer for the 3D market. Helian’s collaboration with 3D printers and filaments provided the desired properties for the colorFabb XT-copolyester.

In Australia, another new player is University of Queensland (UQ) sponsored start-up company, Brisbanebased TenasiTech. It is developing patented, high functioning additives based on research by UQ.

CEO, Richard Marshall, commented at a recent US conference on lightweighting in automotive, “There is a slow but unstoppable revolution happening in the types of materials used in cars, buses and trucks. Models such as the Ford’s F150 and Fusion, GMC Sierra 2014, iBMW, and VW Golf represent just the first of these. We have products which are highly relevant to the needs of newer and lighter vehicles.”

For example, TenasiTech has developed the Solid-TT additive to allow thermoplastics to withstand scratching and maintain their glossy appearance. The poor scratch resistance of acrylic glass is a key barrier to the more widespread replacement of traditional glass, with TenasiTech claiming Solid-TT fits within the existing automotive supply chain, making it an affordable but high performance nanotech solution.

TenasiTech, which set up an office in the US this year, secured funding of A$950,000 from members of investment groups like Brisbane Angels and Melbourne Angels as well as from UQ-based venture fund Uniseed.

Graphene – a breakthrough material

A growing interest for plastics manufacturers is the on-going development for graphene, which the industry considers as a wonder material that has the potential to greatly impact the weight, performance, and functions of products that appeal to the needs and wants of an urbanised population.

It was discovered in 2004 by two scientists, Andre Geim and Konstantin Novoselov from UK’s University of Manchester, whose works on graphene were recognised in 2010 with a Nobel Prize in Physics award.

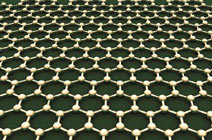

What is graphene? It is a single layer of carbon atoms from graphite, which makes an irresistible alternative to most materials whose properties would soon pale in comparison.

Graphene is said to be 200 times stronger than steel, ten times more effective than copper in conducting heat and it is able to carry 1,000 times the density of electrical current of copper wire, with a surface area that is twice that of carbon nanotubes.

Market growth of graphene

Various initiatives are on the cards to develop further graphene solutions from Europe and Asia. According to European research firm IDTechEx, South Korea and UK have each, respectively, committed at least US$40 and £24 million in the past two years to support graphene development.

Moreover, approximately US$60 million of investments are forged by private firms into the development of the material

The Graphene Flagship is the EU’s biggest research initiative ever, with an allocated budget of EUR1 billion. The project, an academic-industrial consortium aimed at a breakthrough for technological innovation, is embarking on research efforts that cover the entire value chain, from materials production to components and system integration, and is targeting a number of specific goals to exploit the unique properties of graphene.

NanoMaster, an EU Framework Programme 7 (FP7), also supports graphene development in line with its objective to reduce the amount of plastics used to make a component by 50% and hence reduce component weight by 50%, at the same time as imparting electrical and thermal functionality.

It said that this will be achieved by developing the next generation of graphene-reinforced nano-intermediate that can be used in existing high-output plastic component production processes.

The potential commercial value of graphene will grow as it reaches industrial-scale availability and use.

Allied Research has projected that the global graphene market will grow to US$149.1 million by 2020, posting a 44% yearly CAGR from 2014. By 2024, the market (material level) would rise to US$390 million, according to IDTechEx.

Innovations in graphene masterbatches

Spain-based supplier of high-performance nanomaterials and nanotechnology-based solutions Avanzare is said to be the first European firm to produce graphene in an industrial-scale. It is also the world’s largest supplier of the material that has received an award in 2013 for its developments in graphene

“Graphene nanomaterials are gaining enormous interest as a new class of reinforcement for nanocomposites, promising revolutionary electrical, thermal, and mechanical properties,” says Julio Gomez, Technical Coordinator at Avanzare.

Except for a few companies that have been increasing production of graphene, including Graphenano and Granph Nanotech, both located also in Spain, mass-production of graphene has yet to be widely achieved, basically due to high costs and deficient material quality.

Asia may not be producing the material as yet but its applications in electronics and consumer goods are reaching the region’s market.

Nevertheless, the industry has recognised that graphene thermoplastic masterbatches and compounds will drive demand from sectors that require lower weight, greater strength and higher conductivity, not found in commercially available nanomaterials. Aside from electronics, other markets that it can be served include aerospace, automotive, coatings and paints, communications, sensors, solar, oil, and lubricants.

Turkey-based materials specialist Grafen Chemical Industries has introduced a new graphene-based universal thermoplastic masterbatch, GMB-U. It is said to offer universal dispersibility in polyolefins and is aimed towards industrial products.

Said to be easy to use, the masterbatch has been designed for miscibility in all common polyolefins, such as PP and PE, and is processable in film extrusion and injection moulding, says Grafen. With innovative carrier resin chemistry, the graphene sheets exfoliate during thermoplastic compounding and mixing processes, which ensures well bonded and dispersed graphene in polymer matrix.

Since graphene is relatively a new material, its safety and impact to the environmental and human health has not been established, according to NanoMasters. Thus, though it has advantages, it has a long road ahead.

(PRA)