PRA Chinese

Rubber Journal Asia Injection Moulding Asia Energy, Oil & Gas Asia

VISIT OUR OTHER SITES:

PRA Chinese

Rubber Journal Asia

Injection Moulding Asia

Energy, Oil & Gas Asia

Plastics machinery shipments slip 7.5% in 2017 Q1

For the third consecutive quarter, North American shipments of plastics machinery posted a year-over-year decline in Q1 of 2017 according to statistics compiled and reported by the Plastics Industry Association’s Committee on Equipment Statistics (CES).

The preliminary estimate for shipments of primary plastics equipment (injection moulding, extrusion, and blow moulding equipment) for reporting companies totalled US$305.3 million in the first quarter. This was 7.5% lower than the total of U$330.1 million from Q1 of 2016, and it was 14.4% lower than the US$356.7 million from Q4 of 2016. This Y/Y decline in Q1 followed a 7% Y/Y decrease in the quarterly total from Q4 of last year.

“The trend in the shipments data for primary plastics equipment plateaued in the middle of 2016, but then it appeared to roll over in the past few months. The monthly comparisons will be difficult for another quarter or two, so positive growth this year remains unlikely. But the economic fundamentals in the US. should continue to grind gradually higher, and global demand is also expected to improve this year. If Congress passes corporate tax reform in 2017, then an uptrend in the machinery data may re-emerge in 2018,” according to Bill Wood of Mountaintop Economics & Research.

The shipments value of injection moulding machinery decreased 14.5% in Q1 of this year when compared with the total from Q1 of 2015. This sharp drop in the large injection moulding sector was mitigated by gains in the other reporting segments. The shipments value of single-screw extruders jumped 59.1%. The shipments value of twin-screw extruders (which includes both co-rotating and counter-rotating machines) escalated 8.3% in Q1 when compared with last year. The shipments value of blow moulding machines popped 90.4% in Q1.

The upward trend in the auxiliary equipment data remained intact in the first quarter. New bookings of auxiliary equipment for reporting companies totalled US$133.5 million dollars in Q1 of 2017. This was an increase of 11.3% over the total from Q1 of 2016, and it was also a gain of 5.5% when compared with the seasonally strong total from Q4 of last year.

The mixed results from the various segments in the CES machinery data in the first quarter were a bit weaker than the performance in the overall US industrial machinery sector. According to data compiled by the Census Bureau, the total value for new orders of US industrial machinery escalated a moderate 4.7% in Q1 of 2017 when compared with the same period last year.

Another indicator of overall demand for industrial machinery is compiled and reported by the Bureau of Economic Analysis (BEA). According to the BEA, business investment in industrial equipment increased 6% (seasonally-adjusted, annualised rate) in Q1 of 2017 when compared with the previous year.

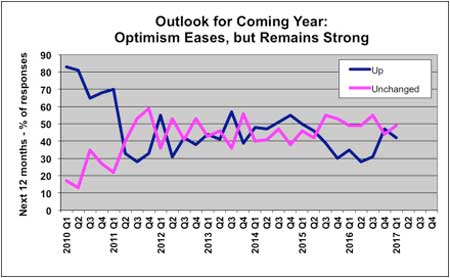

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about expectations for the future. According to the Q1 survey, 87% of respondents expect market conditions to either hold steady or get better during the next year. This is down a bit from 91% in the previous quarter.

The outlook for global market conditions in the coming year was mostly steady in the first quarter. North America was still the region with the strongest expectations for improvement in the coming year. Mexico was expected to be steady-to-better. The outlook for Latin America was more optimistic, while the expectations for Europe and Asia were lower when compared with the previous quarter. The respondents to the Q1 survey expect that packaging will be strongest end-market in the coming year. The expectations for automotive demand were steady. The appliances and construction sectors are bouncing off of recent lows. Expectations for demand from the industrial, medical, and electronics sectors slipped when compared with last quarter.

(PRA)Copyright (c) 2017 www.plasticsandrubberasia.com. All rights reserved.